Wouldn’t it be great if you could just lay out a system to create more success, happiness, and fulfillment in your life?

Well, that’s what I’m going to give you.

And how do I know?

Because after 15 years of applying this simple formula has transformed my life.

First, a little back story.

Like many Americans, I struggled financially, and while I was making decent money as a union electrician, I wasn’t enjoying my day-to-day life as much as I could be.

There was something missing.

Don’t get me wrong, the bills were getting paid, I was blessed to be married to a beautiful woman, and we lived a comfortable life.

But something was missing.

Being in construction, work can be “seasonal.” You might find yourself out of work that day due to weather, a contractor’s mismanagement of the job, or even the fluctuating business economy of boom and bust.

So, I didn’t feel comfortable enjoying life and just did the daily grind. And I rarely took time off for vacations or to relax.

Sound familiar?

One day I came across the book, All Your Worth — The Ultimate Lifetime Money Plan, by Elizabeth Warren and her daughter, Amelia Warren Tyagi, and it changed my life.

At the time, in ’05, Elizabeth Warren was a Harvard law professor and a strong advocate for the middle class and the financial challenges faced by them.

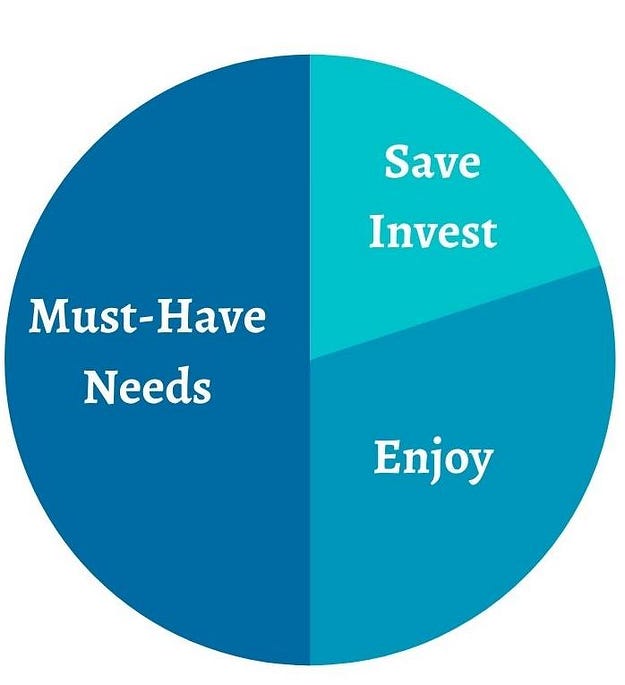

The 50–30–20 Rule

In her book, Warren recommends a simple formula for your financial health.

- 50% of your money goes to your MUST-HAVES/NEEDS.

- 30% of your money goes to your WANTS.

- 20% of your money goes to SAVING and INVESTING for your future.

She then spends a great deal of time helping the reader to understand the difference between wants and needs.

For example, you need a phone, but what you don’t need is the latest iPhone that costs $900.

Also, do you really need all of those streaming services? What would happen if you cancel Netflix? You might find that you actually get more done in less time.

She then goes on to explain that if your needs of housing, food, utilities, exceed the 50% threshold, you have some hard choices to make but they are important if you want to get a handle on your finances.

She explains it in this way, “…Suppose you get laid off. That’s no fun to think about, but we all know it could happen. If your Must-Haves take only 50% of your income, then how would you fare? A lot better than you might think. With Must-Haves at 50%, your unemployment check could cover your needs for several months. (In most states, unemployment insurance covers roughly 50% of your previous salary, up to certain limits.) Knowing you can cover the basics should take some of the terror out of the pink slip!”

She then explains the importance of spending 30% of your money on your wants, because what is the point of living day to day if you’re not enjoying it!

Unfortunately, too many people spend more than 30% on their wants and wonder why they are always struggling to pay their bills.

And finally, the game-changer for me, save and invest 20% of your income for your future. I always had a habit of buying books all my life, I saw myself as a life-long learner but sometimes I would wonder if my money wasn’t better served elsewhere. But now I felt comfortable that all of my reading was investing in my future.

Also, when I read about saving 20% for my future, I realized that I was lucky because as a union electrician, a good portion of my money was already being saved for my annuity and pension accounts.

This might not be the case for you but at least now you know what a good benchmark is for saving for your future with an IRA account and/or Market Index fund.

But I Took the 50–30–20 Rule Further

Elizabeth Warren’s book was fine for money and it is an important factor for life but it’s not all of it.

Time and energy are also important factors of life and I applied the same formula to those two quadrants as well.

I made sure that I spent no more than 50% of my time and energy around people that I had to for work and obligations but that didn’t add to my life.

You know who I’m talking about…

The bullies, blowhards, and blockheads that I engaged with on a day-to-day basis.

I also began making a list of the people who I needed to cull from my schedule because they were not adding value to my life.

Not only were they draining my energy and time but I realized that I was also spending time and energy recovering from the less-than-ideal interactions.

Taking a cue from Blaise Pascal’s, I also scheduled 30% of my time to be by myself.

“All of humanity’s problems stem from man’s inability to sit quietly in a room alone.”

I sought to reconnect with myself and what was really important to me, giving myself time to quiet down and settle from the hectic day-to-day chaotic life.

And most importantly, I actively cultivated a list of people that I wanted to spend more time with, the 20% of people who helped me to invest in my future.

One way I did this is that my wife and I joined a group who traveled on a regular basis and sought to live more fulfilling lives by connecting with like-minded people.

We began planning, scheduling, and doing 3-week international vacation trips with these people each year, making friends, building relationships, and all while seeing the world.

These people and these trips helped me to not only enjoy my life more but also expanded my horizons in so many ways.

These trips were made possible because they were budgeted within the 30% portion of the formula.

So What Will You Do…

Can you see yourself budgeting out your time, energy, and money following the 50–30–20 rule?

What would your life look like if you spent less time and energy around the things you don’t need and instead invest more time for the people, activities, and things you do need?

I can’t even begin to think of all of the cascading events that have happened since I implemented this formula. All of the new people I met introduced me to other people. All of the time I spent happily with me and the people I care about and less trying to settle down from the roller coaster of the dramatic people I knew in my past. The list goes on and on…

What about you?

Some final thoughts…

Of course, the 50–30–20 rule is not written in stone. Some people are doing everything they can, working multiple jobs, scrimping on important bills, just to get by.

On the other hand, some people are doing so well that only 1%, or less, is enough to pay for their must-haves.

The goal is to have benchmarks to start off with so that you can keep yourself out of the hole or hopefully quit the rat race.

When I first started with the formula, I was struggling financially but after almost 20 years, my ratio is more like 30–30–40, where I save and invest more than 40% of my income.

I remember reading that one of the main reasons why Warren Buffett pursued wealth was so that he could have the freedom and autonomy to only work with those people he wanted to. I think that’s a wonderful reason to be wealthy.

Leave a Reply